a) Calculation of payback period.

|

Year |

Cash flows |

Commutative cash flows |

|

0 |

-50000 |

|

|

1 |

-800000 |

|

|

2 |

150000 |

1500000 |

|

3 |

200000 |

350000 |

|

4 |

250000 |

600000 |

|

5 |

300000 |

900000 |

|

6 |

300000 |

1200000 |

|

7 |

300000 |

1500000 |

|

8 |

300000 |

1800000 |

|

9 |

300000 |

2100000 |

|

10 |

30000 |

2400000 |

Payback period= 6 + 100000/300000

= 6.33 years

This project is not feasible because its payback period is greater than firm’s required payback period.

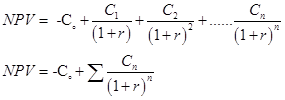

b) Calculation of NET PRESENT VALUE

| Year | Cash flow | Cum cash flow | PV @14% | Present value |

| 0 | (500000) | 1.00 | (500000) | |

| 1 | (800000) | 0.877 | (701600) | |

| 2 | 150000 | 150000 | 0.769 | 115350 |

| 3 | 200000 | 350000 | 0.675 | 135000 |

| 4 | 250000 | 600000 | 0.592 | 148000 |

| 5-10 | 300000 | 240000 | 2.304 | 691200 |

Net present value (-112050)

NPV is negative so project is not acceptable

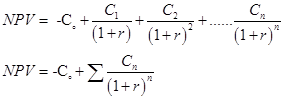

C ) What is the internal rate of return for the project? Is it acceptable? Support your decision with conceptual rationale

| Years | Cash flows | PV @ 11% discount | PV @ 10% discount |

|

0 |

-500000 |

|

|

|

1 |

-800000 |

|

|

|

2 |

150000 |

121743.37 |

123966.94 |

|

3 |

200000 |

146238.27 |

150262.96 |

|

4 |

250000 |

164682.74 |

170753.36 |

|

5 |

300000 |

178035.39 |

186276.39 |

|

6 |

300000 |

160392.25 |

169342.17 |

|

7 |

300000 |

144497.52 |

153947.43 |

|

8 |

300000 |

130177.94 |

139952.2 |

|

9 |

300000 |

117277.43 |

127992.28 |

|

10 |

300000 |

105655.34 |

115662.986 |

NPV @ 11% discount = -31299.75

NPV @ 10% discount = 37393.7

IRR= Lower discount rate+ Difference of discount rates (NPV at lower discount rate/NPV at lower discount rates- NPV at higher discount rate

IRR= 11+1(37393.7/37397.3+31299.75)

IRR=11+ (0.5443)

IRR=11.54%

Because the internal rate of return is less than the required rate of return the project would not be acceptable.