Virtual University of Pakistan

Evaluation Sheet for Internship Report

Spring 2012

FINI619: Internship Report (Finance) Credit Hours: 3

| Evaluation Criteria | Result |

| Report writing | Pass |

| Presentation & Viva voce | |

| Final Result |

Name of Student: BABAR WAQAS Student’s ID: MC100200422

Mistakes have been highlighted. Make corrections and carefully read the comments given in your evaluated report and prepare yourself for presentation. You must be very clear about the each and every task performed by you during your training period. You should be able to interpret the results of the ratios. You also need to be very clear about the units of the ratios. Interpretation of ratios should cover two steps: Step # 1) Result understanding: i.e. what does the answer derived from ratio calculation indicates? You have to critically analyze the result of calculated ratio by explaining the relationship of numerator with that of a denominator. Step #2) Trend Analysis: i.e. what are the variations in a company’s ratio results i.e. the trend for the same company and the reasons for that change in trend? Carefully read lesson 07 and prepare your presentation slides accordingly. You can contact your course instructor, if find any difficulty.

Internship report

On

NATIONAL BANK OF PAKISTAN

Name: BABARWAQAS Student ID: MC100200422 Session: Spring 2012 Submission date of internship report: 22JUNE 2012

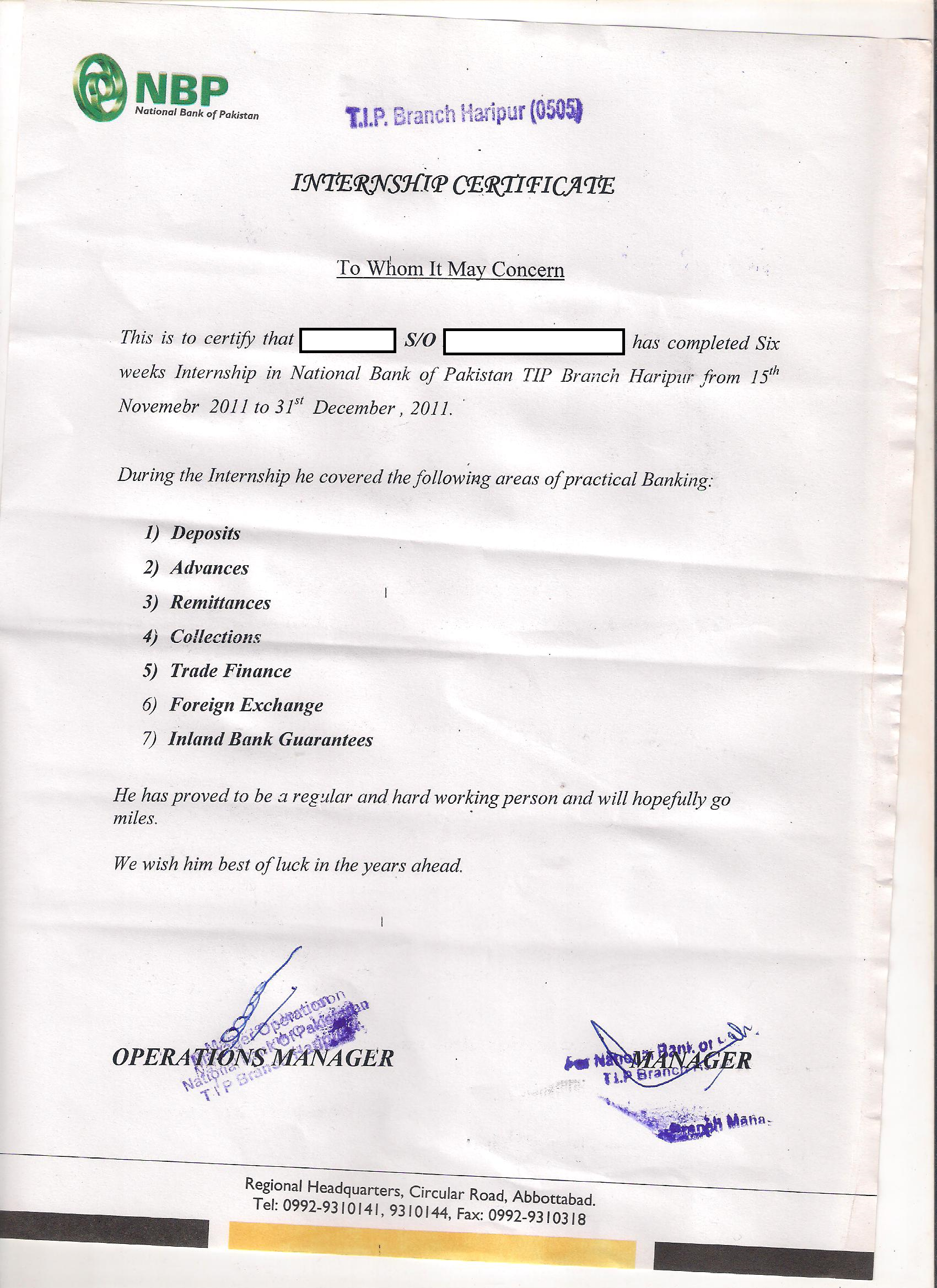

Virtual University of Pakistan Scanned copy of letter of undertaking  Scanned copy of internship completion certificate

Scanned copy of internship completion certificate

Dedication:

This internship report is dedicated to my Parents and all staff of NATIONAL BANK OF PAKISTAN TIP BRANCH Haripur branch from whom I got training without whose efforts, supervision and also prayers I would have been nothing. My parents who ever wished to see me as a successful man in every field of my life praying for their long and prosper life.

Acknowledgement:

I am very thankful & want to express my deepest gratitude to my remittance officer, pension assistances and casher for there supervision, contribution, intellectual guidance, constructive suggestions, valuable time, patience and wise comments to make this report. I wish to express my deepest and sincere appreciation to my friend Mr.waqas his help, cooperation, and moral support

Executive summary

This report is based on internship in National Bank of Pakistan .the report is based on the activities which are performed in national bank branch and detailed of main head office branch by using secondary resources. This report contains introduction, overview of the organization and the brief history of the organization. There are also stated the activities which I performed during my internship in national bank of Pakistan TIP branch haripur. National Bank of Pakistan is a Govt. bank. The head office of NBP is in Karachi. It has over 1250 branches in Pakistan and 22 branches abroad.. Bank is involved in performing many function and services like accepting deposits and making advances of loans, and utility service and also gives overdrafts facility to its credit worthy costumer, loans for investment and credit creation and discounting of bills. During the course of internship I have been assigned different duties. I have worked in all Banking Departments especially in, Cash Department, and Remittance Department &pension department foreign exchange department, account opening department. I tried my best to made repot using the learning and observations during the course, with conclusion and some recommendations. This report highlights the operation and functions of national bank of Pakistan. NBP act as financial agent to its customer in return it gets reward for its services in the shape of profit. Being a government owned institution it plays an important role in development of society as well as in development and growth of the economy. The main purpose of the internship is to gather relevant information to compile internship report on national bank of Pakistan and the branch in which I have completed my internship. The report is based on my six week internship program in national bank of Pakistan tip branch haripur. The methodology reported for collection of data is primary as well as secondary source date. The biggest source of information is my personal experience observation while working with staff and having discussion with them. Recommendations are presented at the end which is based upon the analysis of the data and findings of the study.

Table of contents

| S.No | Page No | |

| 1 | Brief introduction of the organization’s business sector:

|

10-12 |

| 2 | Brief history:

|

12-14 |

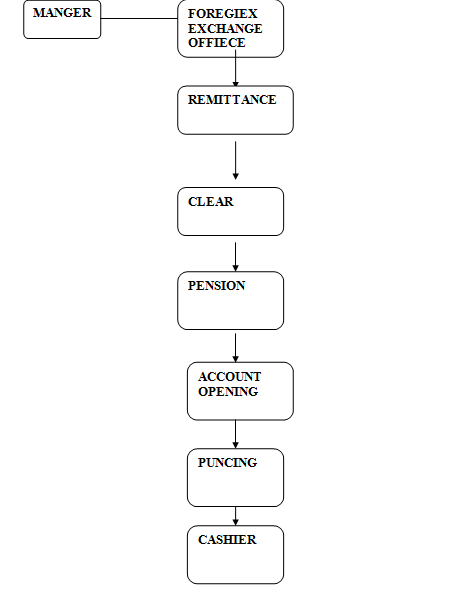

| 3 | Organizational Hierarchy chart: Tip branch hierarchy chart | 15-16 |

| 4 | Business Volume 2011 | 17 |

| 5 | Product and services

|

17-20 |

| 6 | Competitors:

|

20-23 |

| 7 | Brief Introduction of all the departments

FOREIGN EXCHANGE DEPARTMENT:

|

23-25 |

| 8 | Comments on the organizational structure: | 25 |

| 9 | A brief introduction of the branch where you did your internship | 26-27 |

| 10 | Starting and ending dates of your internship | 27 |

| 11 | Names of the departments in which you got training and the duration of your Training | 27 |

| 12 | Detailed description of the tasks assigned to you during the internship program

|

27-33 |

| 13 | Ratio Analysis: | 33-50 |

| 14 | Future Prospects of the Organization: | 50-51 |

| 15 | Conclusion: | 51-52 |

| 16 | Recommendations for Improvement: | 53 |

Brief introduction of the organization’s business sector: National bank of Pakistan incorporated under the national bank of Pakistan ordinance 1949 and listed on the all stock exchanges in Pakistan its head office is situated at chundrigar road Karachi. The national bank is engaged in providing the commercial banking and related services in the Pakistan and overseas. Bank also handles the treasury transactions for the government of Pakistan as agent to the state bank of Pakistan’s. National bank of Pakistan (NBP) is one of the leading and first government recognized bank in Pakistan. NBP was established in November 9, 1949. And it started functioning from November 20, 1949. There are certain characteristics, which sets NBP apart from other nationalized commercial banks. The most important characteristics of NBP is that it works as an agent of the State Bank, where State Bank does not have a branch of its own, The NBP also acts as a trusty to the National investment trust (NIT), which is one of the premier financial institution of the country. It is charged with the responsibility to mobilize of the mobilizing small savings. The establishment of the NBP thus signaled the achievement of another milestone in the development of banking industry in Pakistan. National Bank of Pakistan is one of the pioneer financial institutions of the country, which is working actively in all the field of financings National bank of Pakistan is the largest commercial bank operating in Pakistan. It has redefined its role and has moved from a public sector organization in to a modern commercial bank. NBP headquarters in Karachi and has over 1200 branches country wide. National bank provide both public commercial sector banking services. NBP consolidated its position as one of the top players in corporate and investment banking of the country in 2010 and has built a strong customers relationship with the premier corporate clients NBP work to;

- Meet expectations through Market-based solutions and products.

- Reward entrepreneurial efforts.

- Create value for all stakeholders.

NBP aim to be people who;

- Care about relationships.

- Lead through the strength of commitment and willingness to excel.

- Practice integrity, honesty and hard work. Believe that these are measures of true success.

Bank has confidence that tomorrow it will be

- Leaders in the industry.

- An organization maintaining the trust of stakeholders.

- An innovative, creative and dynamic institution responding to the changing needs of the internal and external environment

Brief history:

National bank of Pakistan was established on November 8, 1949 through passing of a special ordinance in the national assembly. The establishment is came due to the reason when newly born country was facing economic crises. To get rid of the intervention of from the reserve bank of India a self owned and operated central bank by the name of state bank of Pakistan was formed in July 1948 to carry on the responsibilities of issuing the currency and most importantly controlling the flow of money in side the country. The bank commenced its operations from November 20, 1949 at 6 important jute centers in the East Pakistan and directed its resources in financing of jute crop. The bank’s Karachi and Lahore offices were subsequently opened in December 1949.the bank acts as the agent to the state bank of Pakistan for handling provincial/federal government receipts and payments on their behalf. The bank has also played an important role in financing the country’s growing trade, which has expanded through the years as diversification took place. Today the bank finances import/export business to the tune of RS. 52.7 Billion Where as in 1960 financing under this head was only Rs.1.54 billion After the quick growth of 50’s NBP branches worked to establish itself as sound & stable Bank in the early 60’s. The expansion efforts were put into force during these years and Marketing efforts were made to target specific market. The bank also plays a vital role in financing the country’s growing trade which was extended through the years as diversification took place. National bank has earned recognition and numerous awards internationally .it has been the recipient of the bank of the year 2001,2002,2004 and 2005 award by the banker magazine the best foreign exchange bank Pakistan for 2004,2005,2006 and 2007.it has also been presented a recognition award 2004 for having a gender sensitive management by WEBCOP AASHA besides other awards.

Vision:

To be recognized as a leader and a brand synonymous with trust, highest standards of services quality, international best practices and social responsibility

Mission:

- Institutionalizing a merit and performance culture

- Creating a distinctive brand identity by providing the highest standards of services

- Adopting the best international management practices

- Maximizing stakeholders value

- Discharging our responsibility as a good corporate citizen of Pakistan and in countries where we operate

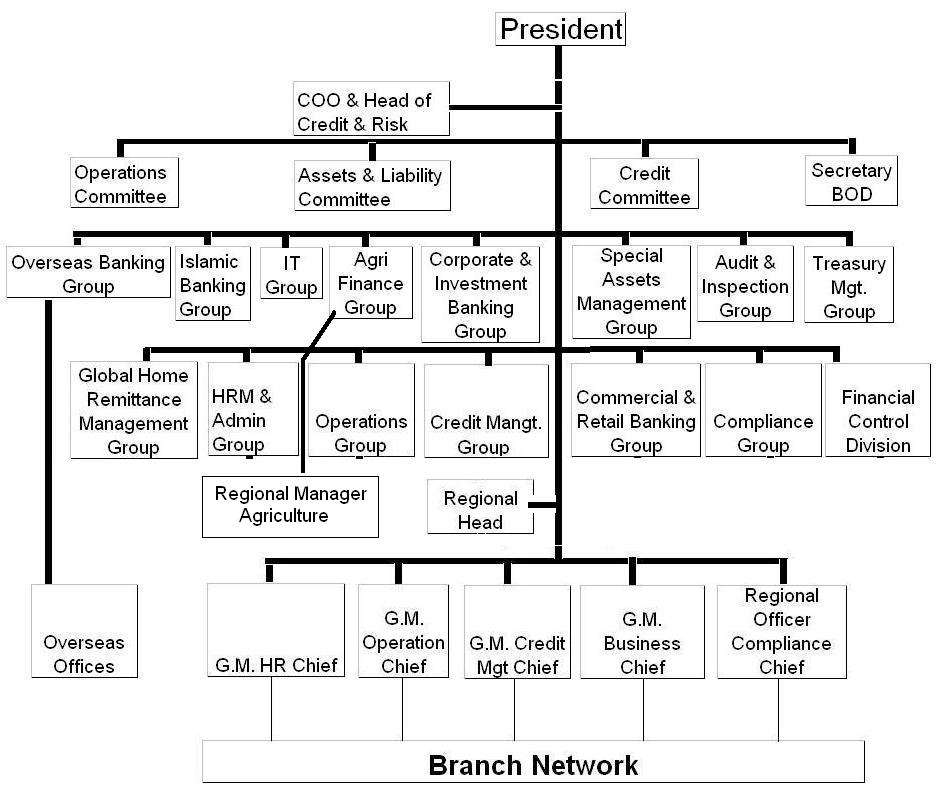

Organizational Hierarchy chart

NATIONAL BANK OF TIP BRANCH HIERARCHY CHART

Business volume:

| YEAR | 2011 |

| Revenue (Rs. In 000) | 95,325 |

| Deposits (Rs. In 000) | 927,421 |

| Advances (Rs. In ‘000) | 525,045 |

| Total assets | 1,149,577 |

| Share holder equity | 110,520 |

| Earning per share | 10.47 |

| No of Employees | 1 4,481 |

PRODUCT AND SERVICES Product lines

- NBP PREMIUM AAMDANI

- NBP PREMIUM SAVER (PLS SAVING ACCOUNTS)

- NBP SAIBAN

- ADVANCE SALARY

- One Card does it all (ATM +Debit Card)

- investor advantage (margin finance facility

- NBP Cash n Gold(ready cash against gold)

- NBP kisan taqat

- NBP kisan dost

- Pakremit ( internet based home remittance service)

- NBP Production Shield (Personal Accident insurance)

- NBP student loan scheme

Treasury products

- Pakistan investment bonds

- Plain vanilla FX products

Derivatives products

- Currency options

- Interest rate swaps and FRAS

- Cross currency swaps

Services

- NBP Online Branch Banking

- Demand drafts

- Mail transfers

- Pay order

- Traveler’s cheques

- Commercial finance

- Letter of credit

- Foreign remittances

- Swift system

- Short term investment

- Equity investment

- N.I.D.A

- Agricultural finance

- Corporate finance

Trade services

- Letter of credit

- Trade collection services

- Payment services

- Trade financing

- Structured trade finance

E Competitors: Public sector:

- First women bank limited (FWB)

- The bank of Punjab BOP

- The bank of Khyber

Private sector:

- United bank limited

- MCB bank ltd

- Standard Chartered Bank limited

- Bank al al-falah limited

- Bank al habib limited

- Askari bank

- Faysal bank limited

- Metropolitan bank limited

- Allied bank limited

- Meezan bank

- Js bank

- Kashf bank

- Atlas bank

- Habib bank limited

- Soneri bank limited

- Union bank limited

- Saudi pak commercial bank ltd

- Dawood bank

- Bank al habib

- Citibank

- Royal bank of Scotland

- Saudi pak bank limited

Brief Introduction of all the departments Cash department: Cash department deal with the payment and receipt of the money and record should be maintained . CLEARANCE DEPARTMENT: A clearinghouse is an association of commercial banks set up in given locality for the Purpose of interchange and settlement of credit claims. The function of clearing house is performed by the central bank of a country by tradition or by law. Advances department: Advances department is one of the most sensitive and important department of the bank. NBP provides advances to different people in different way as demand. type are advance are

- Cash finance

- Overdraft /running finance

- Demand financing/ loans

REMITTANCE DEPARTMENT : This department deals with the transfer of money from one bank to other bank or from one branch to another branch for their customers. DEPOSIT DEPARTMENT: It controls the following activities:

- Account opening.

- Issuance of chequebook.

- Current Account

- Saving Account

- Cheque cancellation

FOREIGN EXCHANGE DEPARTMENT: This department mainly deals with the foreign business. The main functions of this Department are:

- Letter of credit dealing.

- Foreign currency accounts dealing.

- Foreign Remittance dealing.

CREDIT AND RISK MANAGEMENT: An executive risk management committee has been established to emphasize on the bank’s commitment to a robust risk management and risk culture. HUMAN RESOURCE MANAGEMENT: NBP is striving to become an employer of choice through improved HR Policies and competitive remuneration. HRM department hire and train workers. Comments on the organizational structure: The bank has clearly defined organizational structure which supports clear line of communications and reporting relationships. There exist a properly defined financial and administrative power of various committees and key management personnel which supports delegation of authorities and accountability. The organization structure of national bank of Pakistan is centralized because all the decision of the bank is taken by the top management. A brief introduction of the branch where you did your internship: National bank of tip branch haripur established in 1979the branch is established in haripur because near the bank branch there are two main industries they find an opportunity to established branch in haripur so that they get profit from these industries. The name of the bank is national bank of Pakistan tip branch due to the tip industry. The main profit comes from these two industries initially the main source of profit are these two industries TIP and NRTC. An agreement sign between tip and national bank of Pakistan that the national bank will provide the pension to the tip workers in all cities of the Pakistan and tip open a pension account in tip branch now all national bank branches are bound to pay the pension to the employee of the tip. Other industry in NRTC that maintain an account with tip branch haripur. This industry also provides a big profit to the national bank tip branch. Tip branch also deal the export and import of these two main industries. Other sources for revenue are the WAPDA . WAPDA also maintain a account with tip branch haripur. Tip branch use the manual system and customer faces many difficulties. Tip branch is converted from manual system to online system on 14 April 2011.and now also providing the ATM facility to there customers. Starting and ending dates of your internship

| Starting date of internship | 15NOV 2011 |

| Ending date of internship | 31DEC2011 |

Names of the departments in which you got training and the duration of your Training

- Deposits

- Advances

- Remittances

- Collections

- Trade finance

- Foreign exchange

- Inland bank guarantees

Detailed description of the tasks assigned to you during the internship program Deposits: In this department Sir Naseer assign me different tasks. Customer’s comes in bank for depositing amount and have no account so firstly they have to open his/her account in bank. For account opening customer must fill account opening form, signature on the SS card, and deposit initial amount for account opening. I help some customer in filling account opening form, and take their signature on the SS card, after that I attached SS card with account opening form, and fill the initial deposit slip of the customer for opening new account. After all this process I give account opening form and account opening ledger to bank manager for signature. During my internship period I have learnt about KYC stand for know your customer .this is helpful for bank to identify that customer are going to deposits amounts legal money black. This process protect bank from laundering of money because sometime people Deposits their black money into bank and withdraw it after some time and said this is legal money so I have deposited it in bank all of process called laundering. So bank in this way can identify customer source of income. Advance National bank of Pakistan also provide facility to government employees for taking advance salary from bank .I have done work in this department specially for providing advances to government employees .For giving advance salary employees must provide service card and NIC copy .Maximum limit of loan that are given to government employees up to 490,000 and pay back in the shape of monthly salary. In this department sir only assign me the task of recording of advance salary in advance salary ledger, I enter the following information in the advance salary ledger, date, application number of advance salary , and amount of advance salary, loan amount , monthly installment amount , also enter the advance salary account number that bank assign to its customer and also enter the period on the advance salary on the ledger book. Remittance During my internship period I have learnt some important points about this department. Basically Remittance means transfer of money from one city to other. And it is safe mode of payment in this department I have observed some main instruments that are used in it. DD Po TT MT DD means demand draft. It is an instrument that is used for transfer of money from one bank / city to other. I helped the customer in filling dd. In demand draft beneficiary name, bank name, and amount must Mentioned. Beneficiary means a person to whom the payment / money transfer. Po: Payment orders also an instrument that is used to transfer money from one place to other easily and safely. It is like demand draft but main difference is that payment order is cashed and paid out on that bank branch from where it made. But demand draft is paid by different branches of same bank and payment of demand draft is transfer on account while in case of payment order amount paid in cash. TT Telegram Transfer also used as an electronic instrument for transfer of money. MT Mail Transfer for also used for this purpose. When issued demand draft from bank some amount paid as charges in which federal excise duty commission and postage. Federal excise tax is directly credit in government account while commission is credit in bank’s own account In this department sir only assign me the task of making of DD, Sir tell the rate of FED, Postage, and Commission deduction on different amount of DD. I make some DD in close supervision of sir Waqas. Collections This department deals with collection of utility bills, board fee, and deposit of customer. In this department sir assign me task of making of scrolls of utility bills, sir provide me different scrolls for electricity bill, Sui Gas bill and for telephone bills , I enter the consumer id or consumer number form the bill on scrolls and the amount paid, after making all utility bills scrolls I calculate the total amount of the scrolls. Trade Finance In this department sir only tell me the general description of this department. Sir tells me NBP work as a facilitator between importer and exporter. Tip export their products to other country with the help of NBP. Because NBP provide help for ensuring payment to exporter and also to importers bank and against receives commission.NBP open letter of credit on behalf of exporter on importer that is helpful for payment on due date as mention in documents. Inland Bank Guarantee I studied the working process of Inland banking .There were some files notes from the officer. The Contract between Tip and WAPADA on behalf of NBP. Because they have no trust to give payments after receiving a goods that’s why engage bank. So one party not able to give payment at due date receiving party have no fear of receiving amount so in this case bank provide money to that party . Sir tell me that NBP provide three types of grantee’s Performance grantee, warrantee grantee and bid bond Performance grantee to the beneficiary that goods/ services are delivered on time, and according to the agreement. Bank provides warrantee grantee to the beneficiary on behalf of applicant. NRTC is the customer of NBP bank if NRTC Provide grantee that product of NRTC will work 5 year after delivery , if the product of NRTC not work NRTC will replace the product or repair in case if NRTC unable to do that bank will pay the amount to the beneficiary against warrantee grantee. Foreign Exchange I spent few days in this department and learnt how to open foreign currency account and what guidelines before opening any such account. This department deals in foreign exchange. This department is made for the convenience of customers having foreign dealing. It makes easy for them to pay and receive in foreign currencies. Sir Ali told me that foreign currencies account is opened in NBP such as for dollar account minimum balance is required for NBP branch as 100$and the other account is pound is also open that 100pound is the minimum balance and for euro account is 100 euro minimum is required for the FC account . NBP deal with three type of foreign currency account Dolor Yen Pound

Ratio Analysis

Net profit margin: Net profit margin =net profit / net sales *100

| No | 2009 | 2010 | 2011 |

| Net profit | 18,211,846 | 17,563,214 | 17,604,722 |

| Net sales | 77,947,697 | 88,472,134 | 95,325,179 |

| Total | 18,211,846/ 77,947,697 =23.36% | 17,563,214/ 88,472,134 =19.85% | 17,604,722/95,325,179 =18.46% |

Interpretation

Interest income has been contributed in the total bank profit is decreasing and net profit margin is low in 2011 as compare to other years. Ratio show downward trend. Net profit margin is decreasing in 2009, 2010 and in 2011 while the net sale of the bank in increasing in these years due to which net profit margin is decreasing. Net profit margin of bank is decreasing due to increasing in expenses of bank . . You need to interpret the result of the ratios in the following manner: In first step, you need to discuss: What percentage of the total revenue earned (interest income in case of bank) has been contributed in the total profit of the bank. E.g. if the bank’s net profit margin is 25%, it means that 25% of the interest income has been contributed in the total profit of the bank. In second step, you also need to discuss what is the reason behind increase or decrease i.e. which particular factor has affected this change in the percentage, along with your given explanation. 2Gross spread ratio Gross Spread Ratio = Net interest margin ÷ mark-up/return/ interest earned. *100 Net Interest Margin= interest earned – interest expensed. Both the items of the net interest margin are available in the Profit and Loss statement of the bank. Net Interest Margin= interest earned – interest expensed Interest earened = mark-up/return/ interest earned. Interest expensed = mark-up/return/ interest expense

| No | 2009 | 2010 | 2011 |

| Net interest margin | 77,947,697-40,489,649 = 37458048 | 88,472,134 -45,250,476 = 43221658 | 95,325,179 -48,515,618= 46809561 |

| Mark-up/return/ interest earned. | 77,947,697 | 88,472,134 | 95,325,179 |

| Gross spread ratio | 37458048/77,947,697*100 =48.05% | 43221658/88,472,134*100 =48.85% | 46809561/95,325,179*100 =49.10% |

Interpretation

Ratio shows that gross spread ratio is increasing which mean higher the profit margin for bank. GSR of bank is increasing because of the increase in margin. Ratio show up ward trend. Net interest margin is increasing while interest earned is decreasing year to year due to which higher the gross spread ratio. 3Non Interest Income to Total Income = Non Interest Income / Total Income Non-interest income = Non mark-up/interest income (profit and loss) Total Income = Mark-up/return/Interest Earned + Non Mark-up/ interest income. ( p & L ) Net interest income and total income are also available in the Profit and Loss statement of the bank.

| No | 2009 | 2010 | 2011 |

| Non-interest income | 25,788,713 | 33,251,969 | 19,337,04 |

| Total Income | 77,947,697+25,788,713 =103736410 | 88,472,134+33,251,969 =121724103 | 95,325,179+ 19,337,04 = 114,662,22 |

| 25,788,713/103736410 =0.24 times | 33,251,969/121724103 =0.27 times | 19,337,04 /114,662,22 = 0.168TIMES |

Interpretation

Ratio show’s that non-interest income of NBP bank is 0.24 times of total income in 2009, 0.27 in 2010 and 0.16 time in 2011, which is low in 2011 as compare to other two years. Ratio shows increase in 2010 because of increase in non-interest income of the bank. And the decrease in ratio in 2011 due to decrease in non-interest income of the bank. 4-Spread ratio= Interest Earned /Interest Expense Interest Earned = Markup/ Return/Interest earned (P & L) Interest Expense= Markup/ Return/Interest Expense (P & L)

| No | 2009 | 2010 | 2011 |

| Interest Earned | 77,947,697 | 88,472,134 | 95,325,179 |

| Interest Expense | 40,489,649 | 45,250,476 | 48,515,618 |

| =77,947,697 /40,489,649 =1.93 times | =88,472,134/ 45,250,476 =1.96 times | 95,325,179/48,515,618 =1.96times |

Interpretation Larger the interest earn more bank earns. Interest earned is 1.93 time of total income in 2009, 1.96 in 2010 and 2011. NBP spread ratio is increasing which show that NBP worth is increasing. Ratio show upward trend. NBP interest earning is increasing while the interest paid by the NBP is decreasing due to which spread ratio of NBP is increasing. 5 Return on assets: Return on assets = net profit after tax/ total assets*100

| No | 2009 | 2010 | 2011 |

| Net profit after tax | 18,211,846 | 17,563,214 | 17,604,722 |

| Total assets | 944,232,762 | 1,035,024,680 | 1,149,577,736 |

| Total | 18,211,846/944,232,762 *100 =1.93% | 17,563,214/1,035,024,680*100 =1.70% | 17,604,722/1,149,577,736*100 =1.53% |

Interpretation

NBP have 1.93% return on its assets in 2009, 1.70 in 2010, 1.53 in 2011.NBP earning before interest and tax is decreasing year to year. Graph show decreasing trend of return on assets, NBP net profit is decreasing may be due to increase in taxes. NBP return on assets is declining. Falling return on asset contribute negatively to decrease in ROE. Banks has decreasing return on assets which show that company is using its assets not very efficiently to get favorable return on its assets, but return on asset of bank is overall good. . 6 DuPont Return on Assets (Net income/sales)*(sales/total assets)*100

| No | 2009 | 2010 | 2011 |

| (Net income/sales)*(sales/total assets)*100 | 17,561,846/77,947,697*77,947,697/944,582,762*100 =1.85% | 17,563,214/88,472,134*88,472,134/1,035,024,680 *100 =1.6% | 17,604,722/95,325,179*95,325,179/1,149,577,736*100 = 1.53% |

Interpretation

Higher the net income for a given amount of assets, the better is the return The diagram in which ratios are decreasing in 2010 and 2011 respectively as compare to in 2009. In the year of 2009 the dupont return on assets ratio is at 1.85times on which maximum level during the time period as relative to 2010and 2011 7 Return on total equity: Net income/ total equity *100

| No | 2009 | 2010 | 2011 |

| Net income | 17,561,846 | 17,563,214 | 17,604,722 |

| Total equity | 94,141,919 | 103,762,310 | 110520012 |

| Total | 17,561,846/94,141,919*100 =18.6% | 17,563,214/103,762,310*100 =16.9% | 17,604,722/110520012*100 =15.9% |

Interpretation

18.6% is return that Bank is earning on shareholder equity in 2009, 16.9 % is return that Bank is earning on shareholder equity in 2010. 15.9 % is return that Bank is earning on shareholder equity in 2011. Graph show downward trend. Net income of the NBP is decreasing trend due to which return on total equity is decreasing. 8 DEBT RATIOS Debt ratio= total liabilities / total assets

| No | 2009 | 2010 | 2011 |

| total liabilities | 825,676,384 | 906,528,852 | 1,016,926,288 |

| total assets | 944,582,762 | 1,035,024,680 | 1,149,577,736 |

| Total | 825,676,384/944,582,762 =0.87times | 906,528,852/1,035,024,680 =0.87 times | 1,016,926,288/1,149,577,736 =0.88times |

Interpretation

Ratio show that company have debt 0.87 of total assets in 2009 and in 2010 while in 2011 NBP have debt of 0.88 of its total assets. There is an increase in ratio in 2011 which show that the deposits of the bank in increase in 2011 as compare to other two years. 9 DEBT/EQUITY RATIO Debt/equity ratio = total liabilities/ shareholders equity

| No | 2009 | 2010 | 2011 |

| total liabilities | 825,676,384 | 906,528,852 | 1,016,926,288 |

| shareholders equity | 94,141,919 | 103,762,310 | 110,520,012 |

| Total | 825,676,384/94,141,919 =8.7 times | 906,528,852/103,762,310 =8.7 times | 1,016,926,288/110520012 =9.2times |

Interpretation

Ratio show that 8.7 of the NBP Capital structure is debt while the remainder is by investor capital in 2009 and 2010.while in 2011 , 9.2 times of the NBP Capital structure is debt and remainder is investor capital. Deposit and other liabilities are low as in 2009 and 2010 as compare to 2011.There is increase in ratio in 2011 because deposits of the bank is increase in 2011. NBP is using more debt in 2011 as compare to other two year which mean that the deposits of the NBP is increase in 2011. 10 Time interest earned: Earning before income tax (EBIT) /interest expense EBIT =profit before tax+ interest expense Profit before tax = from profit and loss statement (before profit taxation) Interest expense = from profit and loss statement (Mark-up / return / interest expensed)

| No | 2009 | 2010 | 2011 |

| Earning before income tax (EBIT) /interest expense | 61,789,822/40,489,649 =1.53 times | 69,665,595/45,250,476 =1.54times | 74526791/48,515,618 = 1.53times |

Working 2009 EBIT= profit before tax+ Interest expense EBIT=21,300,173+40, 48964 EBIT=61,789,822/40489649 EBIT=1.53 Working 2010 EBIT= profit before tax+ interest expense EBIT=24,415,119+45,250,476 EBIT=69,665,595/45250476 EBIT=1.54 Working 2011 EBIT= profit before tax+ interest expense EBIT= 26,011,173+ 48,515,618=74526791 EBIT=74526791 /48,515,618 EBIT= 1.53

Interpretation

Ratio show that the NBP can meet its interest expenses 1.53 times in 2009 and in 2011 while NBP can meet its interest expenses 1.54 in 2010. Earning of NBP is slightly increased in 2010 as compare to other two year due to which ratio has slightly increase as compare to other years.

11-Advances/Deposits Ratio Formula = (Advances / Deposits & Other accounts) Advances = assets balance sheet Deposits & Other accounts = lab balance sheet

| No | 2009 | 2010 | 2011 |

| Advances | 475,243,431 | 477,506,564 | 525,045,764 |

| Deposits & | 727,464,825 | 832,151,888 | 927,421,438 |

| 475,243.431/727,464,825 =0.65 times | 477,506,564/832,151,888 =0.57 times | 525,045,764/927,421,438 = 0.56TIMES |

Interpretation

NBP is paying advance and loan 0.65 time of its deposit in 2009 while NBP is paying advance and loan 0.57 time of its deposit in 2010. NBP is paying advance and loan 0.56 time of its deposit in 2011. Ratio Show downward trend. NBP have potential to pay advance and additional loans. Downward trend of ratio show that NBP deposit is increasing while advances of NBP is falling. 12 Operating cash flow ratio = cash flow from operating /current liabilities Cash flow from operating= net cash flow from operating activities Current liabilities = maturity table / Working of current liabilities Current liabilities 2011: Current liabilities=9,104,710+236867755+911298458 Current liabilities =1,157,270,923 2010 Bills payable =8,006,631 Borrowings (current portion) =17,154,131 Deposit and other accounts (current portion) =816,172,863 Other liabilities (current portion) = 26,248,782 Liabilities against assets subject to finance lease (current portion) =43,963 Current liabilities total=Rs. 867,626,368 2009 Bills payable =10,621,169 Borrowings (current portion) =37,057,189 Deposit and other accounts (current portion) =655,031,896 Other liabilities (current portion) =22,563,058 Liabilities against assets subject to finance lease (current portion) =20,408 Current liabilities=Rs.725, 293,720

| No | 2009 | 2010 | 2011 |

| cash flow from operating | 41,576,364 | 93,163,784 | 41,345,222 |

| current liabilities | 725,293,720 | 867,626,368 | 1,157,270,923 |

| =41,576,364/ 725,293,720 =0.058 times | =93,163,784 / 867,626,368 =0.108 times | 41,345,222/1,157,270,923 == 0.035TIMES |

Interpretation

Cash generated from operating activities of NBP is 0.058 time of total cash flow in 2009. Cash generated from operating activities of NBP is 0.108 time of total cash flow in 2010 .Cash generated from operating activities of NBP is 0.035 time of total cash flow in 2011. Ratio is increase in 2010 because of increase in cash flow generated from operating activities and decrease is current liabilities. Ratio is decrease in 2011 because of decrease in cash flow generated from operating activities and increase in current liabilities. 13 Dividend per share: Dividend per share= dividend amount / number of equity shares

| No | 2009 | 2010 | 2011 |

| Dividend amount | 5,830,338 | 8,072,777 | 10,090,971 |

| Number of equity shares | 1,076,370.2 | 1,345,462.8 | 16, 818,285 |

| Total | 5,830,338/1,076,370.2 RS=5.42RS | 8,072,777/1,345,462.8 RS=6.00RS | 10,090,971 /16, 818,285 Rs =0.6 RS |

Interpretation

Result of ratio show that bank is performing well financially. Number of outstanding share increase in 2009 and 2011. Their is increase in company market value and dividend per share goes up in 2010 as compare to other two years. In 2011 dividend per share is very low which show that the market price of per share of NBP is decrease or very low. 14 Earning per share: Earning per share= net profit after tax/ number of shares issued

| No | 2009 | 2010 | 2011 |

| Net profit after tax | 18,211,846,000 | 17,563,214,000 | 17,604,722 |

| No of shares issued | 1,076,370,200 | 1,345,462,800 | 16, 818,28.5 |

| Total | 18,211,846,000 /1,076,370,200 RS=16.92RS | 17,563,214,000/ 1,345,462,800 RS=13.05RS | 17,604,722 /16, 818,285 RS=10.4RS |

Interpretation

Ratio indicates that bank earns too high in the year of 2009 .while other years as 2010and 2011 the earning per share are low. The year in which bank earning on shares very high and ,In annual reports showing better financial position as compare to other banks .The earning per share of 2010 are slow at small level as compare to 2009 .The year of 2011 the earning per share are too low as relative to 2009 and 2010 15 Price / earning ratio: Price/earning ratio= market price per share/ earning per share

| No | 2009 | 2010 | 2011 |

| Market price per share | 74.37 | 76.82 | 41.05 |

| Earning per share | 16.92 | 13.05 | 10.47 |

| Total | 74.37/16.92 |

76.82/13.05 |

41.05/10.47 RS=3.92 |

Interpretation

This ratio point out that in the year of 2010 price earning ratio is 5.89 which is positive sign for bank because in that period banks share prices are becoming too high . But in other years as 2009 and 2011 is low as relative to 2010. The year of 2009 at slightly less as compare to compare to 2010.while in 2011 is very low because in this year banks share prices too much low.

Future Prospects of the Organization:

Going forward the bank shall continue to focus on the increasing its deposits with stress on increasing current and saving deposit ratio. Increase in non mark up income with particular focus on to fee income shall be a high priority. Improvement in customer services and strengthening of internal systems and controls shall be remaining a key area of the work. Capacity building in terms of human resources shall continue. Technology up gradation in the form of ongoing implementation of core banking, online connectivity and allied projects will be performed with commitment to complete the jobs on time. Remain committed to vision, mission and core values. Bank is geared up to meet the challenges of tomorrow and leveraging on strengths will continue to capitalize on new opportunities. Add value and esteem for stakeholders.

Conclusions:

NBP have largest branch network of branches in urban as well as in rural areas. NBP is providing valuable services to its customers like online banking system, ATM card etc NBP trying to improve its customer’s services to facilitate the customers. During my internship I observe that branch doing a great business and the management and the staff of the branch is efficient and the professional. Bank has clearly defined organizational structure which supports clear line of communications and reporting relationships. During my internship I observe that behavior of NBP staff is not very good, there is not help desk in branch for helping customers, NBP staff can not handle the customer is rush hour and customer is waiting in lines for taking their own money. Most of the customers in NBP are from government sector, if it is not necessary for government employee of having account in NBP then they switch to other banks due to not providing quick services to its customers.

- Ø Net profit margin of bank is decreasing due to increasing in expenses of bank.

- GSR of bank is increasing because of the increase in margin

- Non-interest income of the bank is decrease in 2011

- NBP has decreasing return on assets.

- Return on total equity is decreasing of NBP

Recommendation for improvement

ü Help desk in branch for helping customers ü Provide training to NBP staff to enhance their skills and capabilities ü New talent should be hired to provide customer better services ü NBP should up-grading their services timely to provide the maximum satisfaction to their customers. ü NBP should pay attention on its marketing efforts to promote its products and services. ü Net profit margin of NBP is decreasing year to year company need to improve its net profit margin by controlling its expenses ü NBP should use its assets efficiently to get favorable return on its assets ü NBP should expand its operations to increase in net income to improve its return on equity ü NBP Should offer advance and loans to its customer to improve its advance to deposit ratio ü NBP should expand its operation and reduce its current liabilities by pay off current liabilities to improve its operating cash flow ratio ü NBP need to improve its market value per share to improve its dividend per share. References and source: Website http://www.nbp.com.pk/ http://www.nbp.com.pk/Publications/index.aspx http://www.nbp.com.pk/Publications/AnReport2010.aspx http://www.nbp.com.pk/Publications/AnReport2011.aspx Personal experience Experience during my internship Information from staff of NBP